Media release: annual results 2011

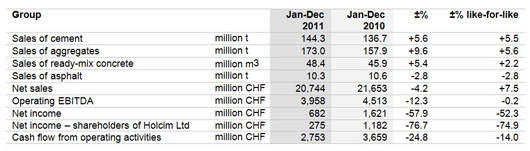

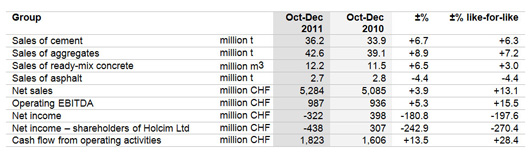

Holcim sold more cement, aggregates and ready-mix concrete, despite some adverse market conditions. On a like-for-like basis, the Group increased net sales, and operating EBITDA reached the previous year’s level. Cash-neutral impairments reduced Group net income. Clearly improved fourth quarter. Organic growth expected at operating EBITDA level in 2012.

Download PDF-version of this media release

Annual results 2011

- Higher sales volumes for cement, aggregates and ready-mix concrete

- Consolidated net sales decreased 4.2 percent (like-for-like: +7.5 percent)

- Operating EBITDA decreased 12.3 percent (like-for-like: -0.2 percent)

- Cash-neutral impairments of CHF 775 million reduced Group net income to CHF 682 million

- At CHF 2.8 billion, cash flow from operating activities remained solid

- Strong balance sheet and high liquidity

- Proposal for a payout from capital contribution reserves of CHF 1.00 (2011: 1.50) per registered share

Fourth quarter 2011

- Positive volume developments for cement, aggregates and ready-mix concrete

- Net sales increased 3.9 percent (like-for-like: +13.1 percent)

- Operating EBITDA increased 5.3 percent (like-for-like: +15.5 percent)

- Cash flow from operating activities increased 13.5 percent (like-for-like: +28.4 percent)

Outlook

- Europe: stable demand

- North America: slightly higher sales volumes

- Latin America: increased demand for construction materials

- Africa Middle East: market conditions unchanged

- Asia Pacific: growing demand for construction materials

- Organic growth at operating EBITDA level

To view a larger version of this table click here.

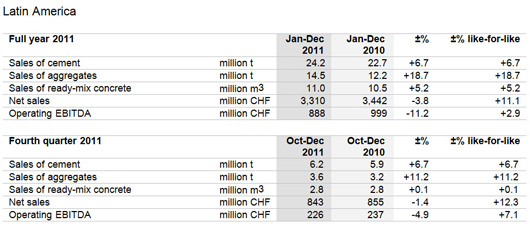

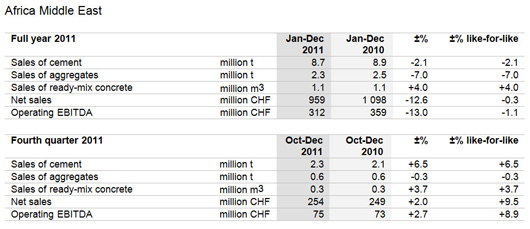

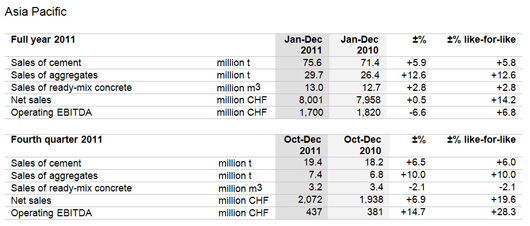

To view a larger version of this table click here.

Emerging markets continue on growth course

Financial year 2011 was characterized by markedly varied economic conditions. While construction activity in mature markets was rather sluggish, emerging economies in Asia and Latin America remained on a solid growth course. Cost inflation increased around the world, which led in particular to higher raw material, energy and transport costs. Natural disasters such as the heavy floods in eastern Australia and Thailand, as well as the earthquake in New Zealand, affected construction activity.

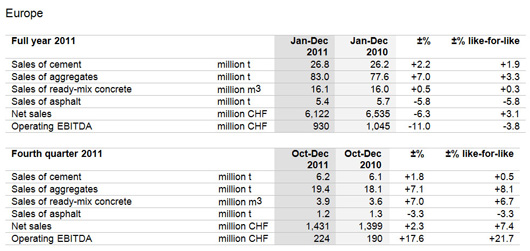

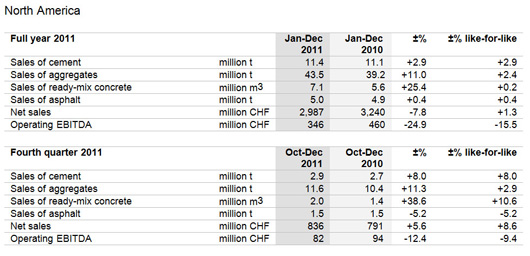

Sales increase in all segments and in the four large Group regions

In four of its five Group regions, Holcim once again sold more cement, aggregates and ready-mix concrete. Only the Group region Africa Middle East saw slight declines in sales volumes. Increases were strongest in aggregates, especially in Latin America and Asia Pacific. In cement, Holcim also sold larger amounts in Latin American markets, followed by Asia. As a result of acquisitions, increases in ready-mix concrete were particularly strong in North America. The greatest organic growth, however, was achieved in Latin America.

In the fourth quarter, cement deliveries increased 6.7 percent to 36.2 million tonnes. The largest sales increases came from the Group regions Asia Pacific and Latin America. Aggregates sales developed positively during this period as well, rising 8.9 percent to 42.6 million tonnes, with Europe and North America achieving the highest level of increases. With the exception of Asia Pacific, deliveries of ready-mix concrete were up in all Group regions, amounting to a consolidated increase of 6.5 percent to 12.2 million cubic meters. Important contributions to this result came from Europe and North America.

Continued cost reduction measures show results

At the beginning of the financial crisis in 2008, Holcim introduced measures to reduce fixed costs. In 2011, further efficiency improvements were undertaken. This primarily involved the temporary or permanent closing of production facilities almost exclusively in developed markets, and not only in cement, but in all segments. Spain, Italy, several Eastern European markets and the US were particularly affected by closures and restructuring.

Capacity increases continued in important markets

In countries with rising demand – primarily in the emerging markets – Holcim continued to increase capacity. In 2011, the new Shurovo plant in Russia began operations. It is currently considered one of the most modern facility in the country and supplies the booming Moscow construction market. Shortly before the end of the year, Garadagh Cement in Azerbaijan produced its first clinker. The newly built kiln line will strengthen the Group company in this attractive market for construction materials. In Latin America, cement capacity was substantially increased in Ecuador. In Asia, which has large deficits in residential and infrastructure construction, Holcim is also in the process of adapting existing capacity to developments on the demand side. In India, ACC began operating what is currently the largest clinker kiln in the world at its Wadi plant. The Chanda plant was also significantly expanded, while Ambuja Cements added additional clinker capacity in Rauri and Bhatapara, as well as two new grinding stations.

The Group company ACC will increase cement capacity in east India by additional 5 million tonnes by early 2015. At Jamul, the existing facility will be replaced by a state-of-the-art clinker plant and grinding capacity increased simultaneously. In addition, the capacity of the existing Sindri grinding plant will be increased, and a new grinding plant will be built at Kharagpur. Both installations will source clinker from the new Jamul plant. Therewith, overall capacity of ACC will increase to 35 million tonnes. The Tuban plant in Indonesia, a dynamic market with great potential, is another installation under construction and will produce cement starting in 2013. Finally, Holcim Brazil will bring a new kiln line on stream at its Barroso plant in 2014.

Like-for-like higher turnover and operating EBITDA at last year’s level

The strong Swiss franc, weaker construction materials markets in certain areas and increased competitive pressure led to consolidated net sales of CHF 20.7 billion, a 4.2 percent decrease. On a like-for-like basis, not taking into account exchange rate and consolidation changes, consolidated net sales actually increased 7.5 percent. While operating EBITDA decreased 12.3 percent, on a like-for-like basis it remained virtually stable at minus 0.2 percent. The substantially improved financial results of Holcim Russia and Holcim Australia, as well as of the Group companies in Indonesia, Singapore, Colombia and Switzerland, had a positive effect on the year-end results. In many markets, increased costs due to inflation, especially for raw materials and energy, could not be completely passed on to sales prices. This, combined with various local factors, negatively affected performance above all in the Philippines, India, North America and Great Britain.

In the fourth quarter, despite strong exchange rate volatility, which reduced operating results by CHF 98 million, operating EBITDA rose by 5.3 percent compared to the same quarter a year before. On a like-for-like basis the increase was 15.5 percent, above all thanks to Group companies in Asia Pacific and Europe. In Europe, the sale of CO2 emissions certificates added CHF 52 million to operating EBITDA (fourth quarter 2010: 20). In Asia Pacific, operating EBITDA rose 28.3 percent on a like-for-like basis.

Cash-neutral impairments affect net income

As part of the South African policy to support Black Economic Empowerment (BEE), Holcim in 2007 sold its majority stake in AfriSam (formerly Holcim South Africa) to a BEE-compliant consortium. Since then the Group has held a 15 percent stake in the company. As demand for construction materials has heavily decreased since 2010, AfriSam found itself forced to carry out far-reaching financial restructuring measures during the reporting year. In this connection, Holcim had to write-off CHF 415 million, which is made up of a notes issue, accrued interest and foreign currency movements, of its investment. The stake in AfriSam is now at 2 percent.

In Spain, parts of Eastern Europe and in the US, Holcim has also been forced, due to unsatisfactory demand, to make value adjustments on property, plant and equipment, as well as goodwill, of a total of CHF 360 million.

Due to these cash-neutral impairments totaling CHF 775 million, net income has been reduced by 57.9 percent to CHF 682 million, and the share of net income attributable to shareholders of Holcim Ltd to CHF 275 million. Cash flow from operating activities came to CHF 2.8 billion. Cash flow generation was particularly strong in the fourth quarter 2011.

Continued solid balance sheet

Holcim continues to show a solid balance sheet and good liquidity. Although new plants came on line and others are under construction, net financial debt only rose by 1.6 percent to CHF 11.5 billion.

Payout to be proposed to Annual General Meeting

Despite the above-mentioned cash-neutral impairments, the Board of Directors will propose to the Annual General Meeting on 17 April 2012 in Zurich, a payout from capital contribution reserves of CHF 1.00 per registered share (2011: 1.50).

Change in Group leadership

The change of CEO, which was announced in September 2011 with effect from the beginning of February 2012, was part of a generational change in the Group’s leadership. Markus Akermann, who has been with Holcim since 1978, was elected to the Executive Committee in 1993, and took over the function of CEO in 2002. Under his leadership the Group experienced considerable growth. Through important acquisitions Holcim was more clearly positioned towards future-oriented markets, and as part of the "Twin Leg" strategy, the aggregates segment was expanded. On top of this there was the "Passion for Safety" initiative, which put workplace health and safety at the center of the whole Group, as well as the great efforts to strengthen sustainable development at the Group. Markus Akermann will remain a member of the Board of Directors. The Board and the Executive Committee would like to take this opportunity to thank him for his successful efforts throughout the years.

On 1 February 2012, Bernard Fontana, 50, took over as CEO from Markus Akermann. He began his career at Groupe SNPE, where he was a member of the Executive Committee from 2001 to 2004. He subsequently moved to the steel company ArcelorMittal where, as a member of the Executive Committee from 2006 to 2010, he was initially responsible for the overall automotive business, and subsequently for Human Resources as well as the alliance with Nippon Steel. Since 2010 Bernard Fontana has been CEO of Aperam, a listed company domiciled in Luxembourg which was spun off from ArcelorMittal and which produces stainless steel in Europe and overseas.

Outlook for 2012

Holcim expects demand for building material to rise in emerging markets in Latin America and Asia, as well as in Russia and Azerbaijan in 2012. A slight improvement for North America can also be expected. In Europe, demand should remain stable, provided that the situation is not undermined by further systemic shocks. In any case, Holcim will accord cost management the closest attention and pass on inflation-induced cost increases. Holcim’s approach to new investments will be cautious. Holcim expects that the Group will achieve organic growth in terms of operating EBITDA.

Key figures on Group regions

To view a larger version of this table click here.

To view a larger version of this table click here.

To view a larger version of this table click here.

To view a larger version of this table click here.

To view a larger version of this table click here.

Further documents such as the Annual Report 2011 including detailed information on the Group regions (p. 82-103) are available at www.holcim.com/results

* * * * * *

Holcim is one of the world's leading suppliers of cement and aggregates (crushed stone, sand and gravel) as well as further activities such as ready-mix concrete and asphalt, including services. The Group holds majority and minority interests in around 70 countries on all continents.

* * * * * * *

This media release is also available in German.

* * * * * * *

Corporate Communications: Tel. +41 58 858 87 10

Investor Relations: Tel. +41 58 858 87 87

* * * * * * *

Media conference:

29 February 2012, 9:30 am, Hagenholzstrasse 85, Zurich

Analyst presentation and webcast:

29 February 2012, 12:00, Hagenholzstrasse 85, Zurich

www.holcim.com/broadcast